Distinguish your financial institution by using industry-leading data to measure branch visits, conquest new business, create brand loyalty, and strengthen relationships.

Highly Targeted Audiences that Perform

- Custom audiences derived from location analytics, demographics, census tract, and first-party customer data can power successful multichannel campaign delivery

- Activate any audience for digital, CTV, social media or direct mail with a few easy steps

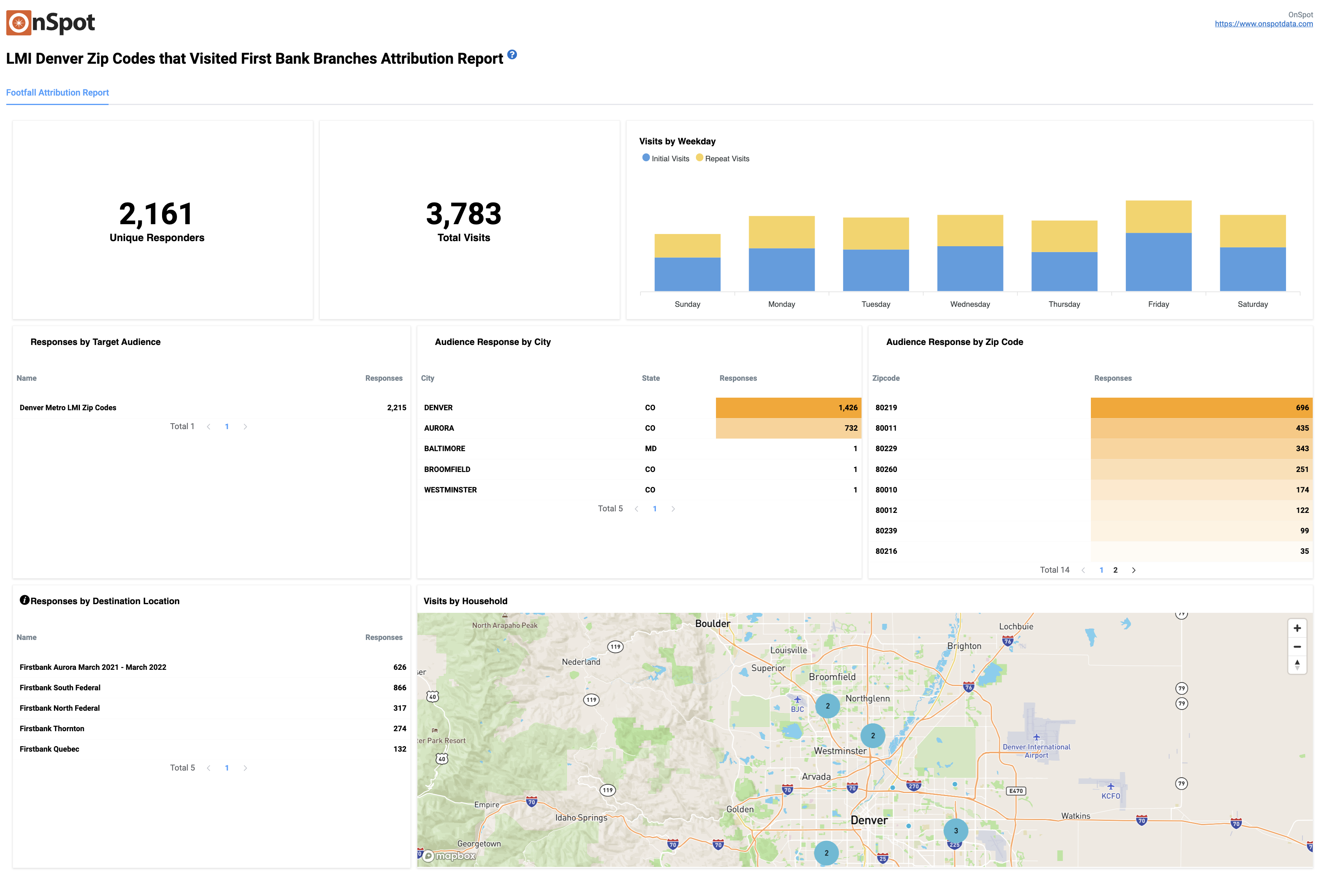

- Attribution reporting measures campaign performance on both real-world and online visitation from your target audiences to your branch locations or to your website

- Campaign responders can be utilized for remarketing efforts or for analytics reporting to further understand your customer base

- Evaluate sales lift, ROI, and CPA (Cost per Acquisition) through additional reporting capabilities tying customer data back to the original target audiences

Precise Analytics for Critical Business Decisions

OnSpot’s technology relies on real foot traffic, website visits, and household data. Our measurement data is never modeled or extrapolated. Insights reports quickly provide a broad sample of behavioral data for your location(s) including popular days and times to visit, visitor household information, and more. Demographic data helps identify key audience characteristics such as age, gender, financial information, and interests

Our Trade Area tool allows you to better understand the households and workplaces in local proximity to your location(s). Compare trade areas to analyze households that visit your locations, a competitor, or both. Use this information inform future site planning or potential investment opportunities.

Common Use Cases for Financial Institutions:

Customer Acquisition & Loyalty

Create a custom radius around your location(s) to capture local households, workplaces or both using our Trade Area tool. Promote your business and create brand awareness through digital advertising or direct mail to these potential customers. Additionally, reach visitors to your competitors to increase market share.

Upload first-party customer data and analyze against location or website visitors to create target audiences receptive to your message. Retarget these customers with offers to try out new products and services or loyalty programs.

Market Research

Measured over time, location visit behavior can be used as part of broader market research efforts. By analyzing foot traffic patterns across various industries and markets, you can gather valuable intelligence on consumer trends, preferences, and spending habits.

This data can provide a competitive advantage in understanding market dynamics, predicting future demand, and pinpoint emerging opportunities or threats.

Investment Analysis

Location visit patterns can provide valuable insights into the performance and potential growth of businesses in many verticals. Gain a better understanding of consumer behavior, evaluate popularity of certain products or services in a specific market, as well as evaluate the overall health of different industries.

This information can help your institution make informed investment decisions by identifying promising companies or sectors to invest in, or detecting potential risks.

Community Reinvestment Act Compliance

The Community Reinvestment Act (CRA) requires banks to add new customers from rural or low-income markets.

Using the Integrated DSP Solution, you can execute campaigns that exclude existing customers and deliver targeted ads (digital media and direct mail) to the specific census tract(s) and households that qualify under the CRA. These offers can customized to resonate with the targeted economic and demographic groups.

Report on campaign results through attribution reporting detailing the foot traffic and website visits from the served audience across any channel. Prove compliance by matching household addresses that received advertising back to the rural and low-income households identified in your target audience.